The Dutch ‘Coöperatie’ is a good alternative to the Dutch BV

The ‘Coöperatie’, or cooperative, is a legal entity that is comparable to a BV, but has much more flexibility. Profit rights and voting rights can be attributed to the members in different ways, and this can change along the way, without going to the notary. And especially if you plan to move out of the Netherlands in due course, there is another advantage: you may be exempt of dividend taxes.

The law on cooperatives (‘coöperatie‘) as a legal entity in the Netherlands is extremely short and mostly refers to the (also relatively short) law on associations. There are only few functional limitations and the best news is: even foreigners and foreign legal entities can incorporate a cooperative or be a member. Once established, the cooperative keeps its own record of members.

For the rest the coöperative is comparable to the BV: it is a separate legal entity, you can transfer the ownership and if the cooperative goes bankrupt, you will only loose the capital you brought in. At least, if you use the variety ‘Coöperatie U.A.’, the one with excluded liability for the member, with most people do.

Coöperatives for investments

In a cooperative you can make voting rights and profit shares dependent on the capital that you put in the coöperative. This way the legal entity works like a BV (or limited company), but is much more flexible where it comes to injecting more capital and adding investors.

The concept of the start-up cooperative

A lot of start-ups end because of internal disagreement about how to split the shares. For example if you both have 50% of the shares and one of the founders gets ill, goes on honeymoon or pursues a different venture. Or it turns out that you need an additional team member, who also would like to have shares.

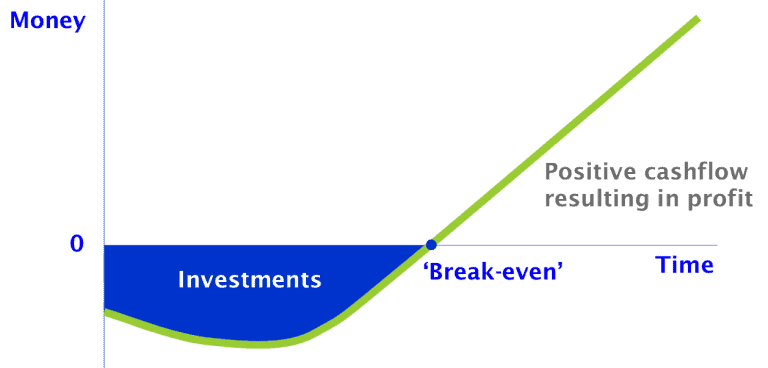

The concept of the start-up coöperatieve is this: the more you invest in time and cash, the more ‘shares’ you get. This way each founder or team member can build up shares up to the moment that your venture is break-even and you have sufficient income to pay all costs and salaries. Every month the team sits together to determine how much every team member contributed. The cumulative investments of each member determines his or her share in the profit and can also determine the voting rights.

If you need to add a new team member, you can just decide on that together, there is no need to go to a notary. And in case you want to sell (part of) your venture, and the buyer prefers a BV, you can easily transfer the cooperative into a BV during that transaction.

How about taxes?

In general it makes sense to incorporate in the Netherlands if you live here or if at least a part of the activities of the start-up will be in the Netherlands.

As the cooperative will be incorporated in the Netherlands, the Dutch tax authorities will treat it as a Dutch legal entity, and you have to pay the Dutch company tax (Vennootschapsbelasting). For smaller companies this will be 16,5% of your profits. For founders living in the Netherlands, any dividend may either be treated as part of your income as an entrepreneur, or as ‘Aanmerkelijk belang’, which means that you pay an additional 26,5% on the payouts.

If you live outside of the Netherlands, any dividend payouts will be taxed according to the laws of your country. Please note that if the board members of the cooperative live abroad, the tax authorities of that country may also think the coöperative is under their jurisdiction. Or there may be a tax treaty that arranges this. So please check this in advance.

The proces of setting up a cooperative

De Coöperatie expert is a team of 8 specialists on cooperatives. We work with our own public notary and we helped over 1500 groups with incorporating cooperatives. Although part of the documents will be in Dutch, we can do the explanation and further communication in English and we can arrange English translations for you.

We always start with a consultation of about two hours, in which we check whether the cooperative really covers your needs and what specific things we need to keep in mind. We will answer all your questions and explain the concept in detail.

If you want to incorporate as a private person, you need to have a BSN number in the Netherlands. If you want to incorporate as a company, you’ll need an extract from the companies registry (in the Netherlands: de Kamer van Koophandel) that you can act on behalf of that company. In case the extract is not in English, you need a certified translation. Please consult with us in advance. You also need to be able to understand the deed in Dutch, and discuss the main points in Dutch with our notary office.

Within two days after the consultation we will email you the draft for the articles of incorporation. You can check these, amend where necessary and then we will send you a power of attorney that you can legalise with a local notary. You can send this to our own notary, who will pass the deed.

After incorporation you will also receive the set of rules for the valuation of time, cash and other contributions that you and the other team members will make. This set of rules also covers a number of points that would otherwise be in a shareholders agreement, e.g. about setting hourly rates, what kind of expenses are reasonable and also ‘drag along’, ‘tag along’ and non-competition statements.

The whole package as describe above will cost you 1490 euro excluding VAT. The VAT you can claim back if you are registered as an entrepreneur in the Netherlands or you can claim it back through the cooperative after incorporation.

Please contact us for any questions

If you want to know more, please contact Alfred Griffioen